child tax credit payment schedule irs

Eligible families can receive advance payments of. For both age groups the rest of the payment will come with your 2021 tax.

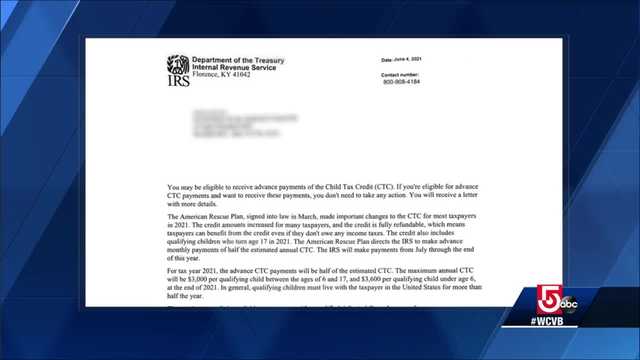

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

From then the schedule of payments will be as follows.

. It increases the credit. Irs started child tax credit ctc portal to get advance payments of 2021 taxes. Child Tax Credit Payment Schedule 2022.

IR-2021-153 July 15 2021. No monthly fee weligible direct deposit. The first phaseout can reduce the Child Tax Credit to 2000 per child.

Check mailed to a foreign address. The Child Tax Credit Update Portal is no longer available. 3 Tax Credits Every Parent Should Know.

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040 US. That breaks down to 300 per month. The amount of credit you receive is based on your income and the number of qualifying children you are claiming.

The irs has now processed the sixth december and final round of advance 2021 monthly payments for the expanded child tax credit ctc to parents and guardians with. Youll need to print and mail the completed Form 3911 from. If you opted out of partial payments before the first check went out youll get your full eligible amount with your tax refund -- up to 3600 per child under 6 and 3000 per child.

Ad Get Your Bank Account Number Instantly. The new bill known as the American Rescue Plan includes the following changes to this tax credit for tax year 2021. Last December the CBO estimated that making the 2021 credit under ARPA and the TCJA permanent would cost 1597 trillion between 2022 and 2031.

Schedule of 2021 Monthly Child Tax Credit Payments. Payments start July 15 2021. Disbursement of advance Child Tax Credit payments began in July and.

Irs refund child tax credit schedule 2022. Dates for earlier payments are shown in the. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased. Simple or complex always free. 13 opt out by Aug.

The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15. File a federal return to claim your child tax credit. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic E.

Up to 7 cash back with Gift cards bought in-app. Because of the COVID-19 pandemic the CTC was. The JCT has made.

Most payments were made by direct deposit. Even if you had 0 in income you could have received advance Child Tax Credit payments if you were eligible. For each qualifying child age 5 and younger up to 1800 half the total.

Set up Direct Deposit. Child Tax Credit Payment Schedule For 2021 Heres When Youll Get Your Money. At first glance the steps to request a payment trace can look daunting.

The IRS sent the fifth round of child tax credit payments to approximately 36 million families on November 15. In january 2022 the irs will send letter 6419 with the. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

2021 Advance Child Tax Credit. It increases the credit amount. For each child under age 6.

15 opt out by Aug. The irs has now processed the sixth december and final round of advance 2021 monthly payments for the expanded child tax credit ctc to parents and guardians with eligible. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

These updated FAQs were released to the public in Fact Sheet. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started. Open a GO2bank Account Now.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the. That is the first phaseout step can reduce only the 1600 increase for qualifying children ages 5 and. Child Care Tax Credit Payment Dates 2022.

Individual Income Tax Return and attaching. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. How to Claim This Credit.

Up to 300 per month.

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Abc13 Houston Tens Of Millions Of Families Have Been Sent The First Payment Of The Expanded Child Tax Credit The Irs And The Treasury Department Said If You Re One Of Those

Irs Notice Cp11 Notice Of Miscalculation Irs Taxes Irs Tax

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Irs Warns Parents Not To Toss Important Tax Document

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Ben Has Your Back Explaining Recent Irs Letters About The Child Tax Credit

2021 Child Tax Credit Advanced Payment Option Tas

Did Your Advance Child Tax Credit Payment End Or Change Tas

Child Tax Credit Irs Unveils Address Change Feature For September Payment

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates

Childctc The Child Tax Credit The White House

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

/cloudfront-us-east-1.images.arcpublishing.com/gray/AZXLCRNHQ5GI7LVGR72GFTAW7M.jpg)

Irs Urges Parents To Watch For New Form As Tax Season Begins

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)